Guest post by Vaughn Stoll, SVP and Director of Acquisitions for Brown & Brown.

Several interconnected variables are consistently at play with the U.S. economy which impacts the marketplace for M&A deals. These variables have laid the groundwork for a tangled web of influences in 2025, which looks a lot like this:

- The Fed will influence interest rates based on inflation

- Inflation is affected by both interest rates and GDP

- Claims costs are impacted by inflation and the frequency and severity of loss events

- Insurance rates are impacted by claims cost trends

- Claim costs and inflation impact insurance rates

As demonstrated here, the political climate impacts interest rates, GDP growth, tax rates and insurance rates. Then, all of those impact the valuation of insurance agency M&A.

The recent presidential election results signal a shift toward pro-business policies, which could create a favorable environment for acquisitions over the next few years. We anticipate this new climate will contribute to steady M&A activity in the year ahead. However, next year will not likely support an increase in acquisition multiples for most agencies. If capital gains rates remain favorable as expected, that should help maintain sellers’ interest in M&A.

Related: How do private equity investment returns stack up in the current M&A market?

Ultimately, the law of supply and demand will determine the impact on valuations. However, the expectation is that valuations will remain relatively flat. Given the multiples of some of the large transactions announced in late 2024, will multiples for large acquisitions decrease in 2025 from their peak in 2023 and early 2024? As multiples for large deals increased in the last 10 years, multiples for mid-size deals gradually followed. The final question is: If multiples for large deals slightly decreased, will multiples for small to mid-size deals do the same? Only time will tell.

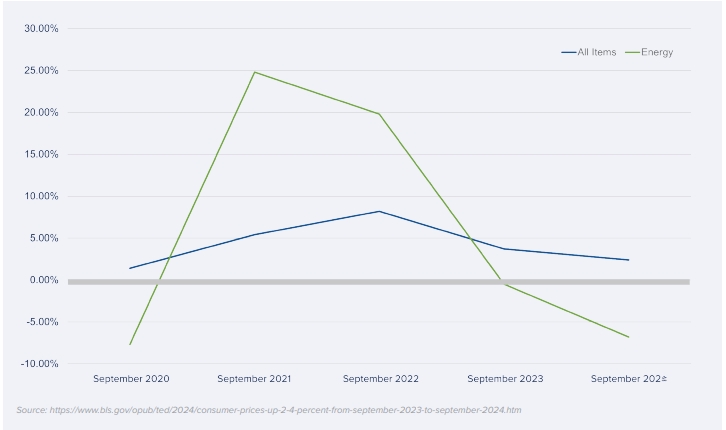

Interest rates will continue to decrease as inflation moderates, but don’t expect drastic changes in 2025.

Signs of slowing inflation should perpetuate the downward trend in interest rates in 2025, though significant shifts are unlikely. Depending on its fiscal and trade policies, the new administration’s focus on economic growth could further influence these rates.

We anticipate additional interest rate cuts in 2025, but this is largely dependent on inflation remaining stabilized throughout the year.

How will this affect M&A?

Inflation affects interest rates, which in turn influence valuations. The interconnectedness of these variables directly impacts M&A activity and outcomes.

When inflation skyrocketed in 2022, claims became much more expensive than the actuarial models had predicted, contributing significantly to the onset of the hard market.

As inflation rates soften, claims costs could follow suit. Lower inflation and potentially positive underwriting results could help ease the hard market. If the market softens, that could negatively impact M&A valuations.

Another variable to consider, though, is the severity of climate-fueled catastrophic losses sustained in 2024. In a year marked by unpredictable natural events, increasingly severe and unexpected storm damage can significantly impact rates and the state of the market, especially when the devastation is worse than models and predictions accounted for.

Related: An Inside Look at M&A Strategies for MGAs

Projected U.S. economic growth rates are the lowest they have been in the past four years.

The Real GDP growth rate was 2.9 in 2023 and is estimated at 2.6 in 2024 and 1.7 in 2025.

Slowing discretionary spending and income growth, government spending constraints and a rising unemployment rate will all contribute to less significant economic growth in the next year.

A surge in retirement fueled by the Baby Boomer generation is slowing labor force growth, which is also partly responsible for lower economic growth rates. Retirements and exits by an aging workforce mean fewer workers to produce goods and provide services, dampening overall economic growth.

How will this affect M&A?

If the middle market economy slows, this could lead to a slight decrease in M&A valuations.

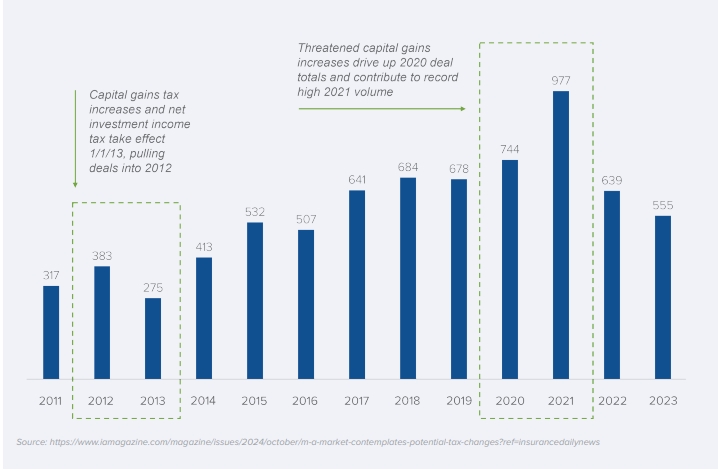

Concerns of capital gain tax increases ease, giving sellers more time to make decisions.

The recent election results may alleviate concerns about capital gains tax increases, potentially reducing the urgency for sellers to accelerate M&A activity in Q1 and Q2 in 2025. The current environment could lead to a steadier flow over the next few years rather than a sudden spike in activity.

How will this affect M&A?

With capital gains tax rates likely remaining stable, the supply of acquisitions may be more consistent rather than seeing a temporary increase. This will likely have a net neutral impact on valuations.

The glass is half full.

At Brown & Brown, we remain cautiously optimistic about the outlook of the insurance industry in 2025. Private equity shows signs of remaining steady, which will help sustain acquisition interest despite broader uncertainties. We expect a reasonable amount of sales activity as we move into the new year.

We’re still actively acquiring in all three divisions: retail, programs and wholesale brokerage. Our team looks forward to talking with you about opportunities around acquisitions that fit culturally and make sense financially.

Related: Why cultural alignment shapes Arrowhead Programs’ M&A strategy

Interested in speaking with our Mergers & Acquisitions team? Email Jimmy Curcio or acquisitionsdept@bbins.com.