Orchid Insurance, one of 31 Arrowhead Programs companies, is a program administrator and wholesale broker focused primarily on the Florida homeowners and E&S markets. Orchid is among the largest specialty underwriters of catastrophe-exposed property insurance in the United States.

Orchid’s president and CUO, Ross Bowie, was recently interviewed by John Weber at AM Best TV during WSIA’s fall conference. Weber asked why the Florida homeowners market is so different from other states.

Bowie stated several reasons:

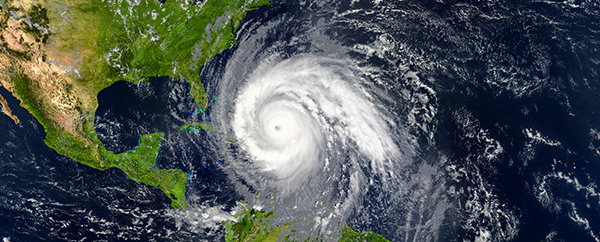

- It’s one of the few states that regularly deals with hurricanes every fall.

- It has a “robust attorney environment”: “Every insurance fraud or scheme that hits the U.S. seems to originate in Miami,” Bowie explained.

- Due to Florida being a highly litigious state, Orchid is very focused on contract language, down to where commas are placed, to reduce any “creative” litigation.

The key is not only understanding what type of risk protection you can get at the right rate, but also factoring in the right terms, said Bowie. Orchid underwriters also have the flexibility to limit certain coverages, add caps or further deductibles. This allows for better risk management and enhanced profitability.

His advice to agents: Be specialists in the market that you’re writing in. Invest in the technology tools you need to be able to collect and analyze your market data.