“Our venture into APIs and third-party distribution platforms started in 2020. Using an API, we wanted to allow agents to submit business in a more streamlined fashion, which will increase our submissions and bound policies,” explains Tiffany Poletti, Core Commercial’s COO. “Whether you call them aggregators, comparative raters or third-party distributors, they create a greater ease of doing business for agents.”

We talked awhile back with Poletti and Heidi Williams, strategic API program manager, Arrowhead Programs CIO Joe Shomphe and James Wilson, lead application integration architect, to discuss our activity in building APIs and launching them on third-party aggregators.

First, what’s an API?

Think of an API as a server at a restaurant who presents you with a menu describing dishes that you can order. When you make your menu selections, the server sends your order to the kitchen and delivers your choices back to your table. Like the restaurant server, an API connects you to the data (menu items) you want from the place (a comparative rater) you want to retrieve it from.

How can an API help your business? In six ways, says Williams.

- Automate manual processes

- Provide data in real-time

- Reduce number of manual touch points

- Eliminate double data entry

- Reduce costs

- Enhance the customer service experience

“APIs enable our businesses to reach a larger audience, meeting our producers in the digital channels they already frequent,” Williams explained.

If agents don’t use comparative raters, they must go to each company’s website and enter the exact same information on several different sites to get their rates. These comparative raters allow them to enter the information just once to get pricing and coverage options from different carriers or MGAs all at one time.

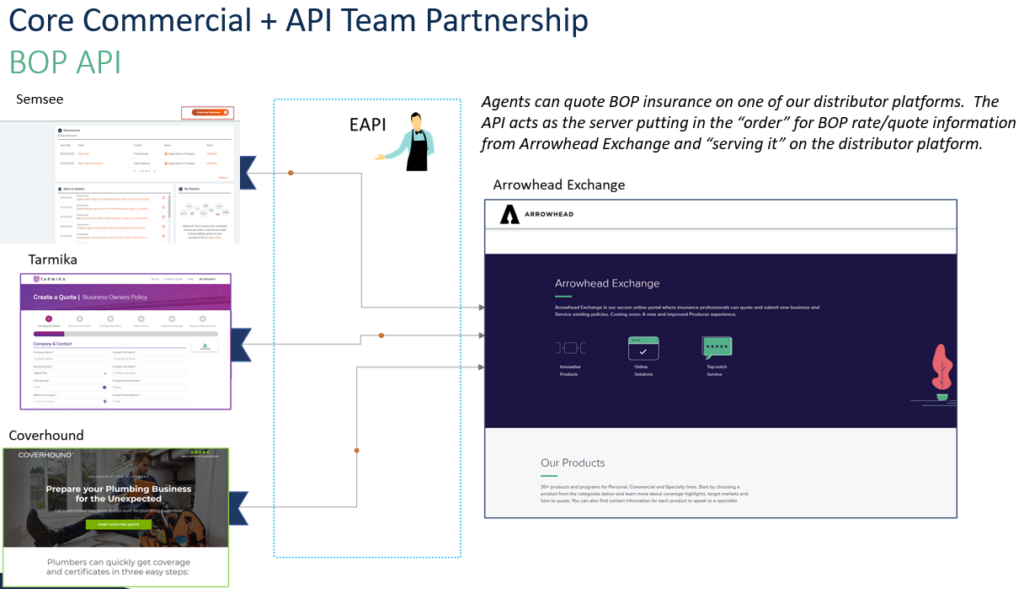

In basic terms, the API that we provided for one of our programs allows agents to request a quote, adding in the pertinent information, and get that quote right back with a rate. We took an existing platform like Arrowhead Exchange and created an API interface that’s used on various raters or aggregators like Coverhound, Tarmika and Semsee, all three of whom we use today.

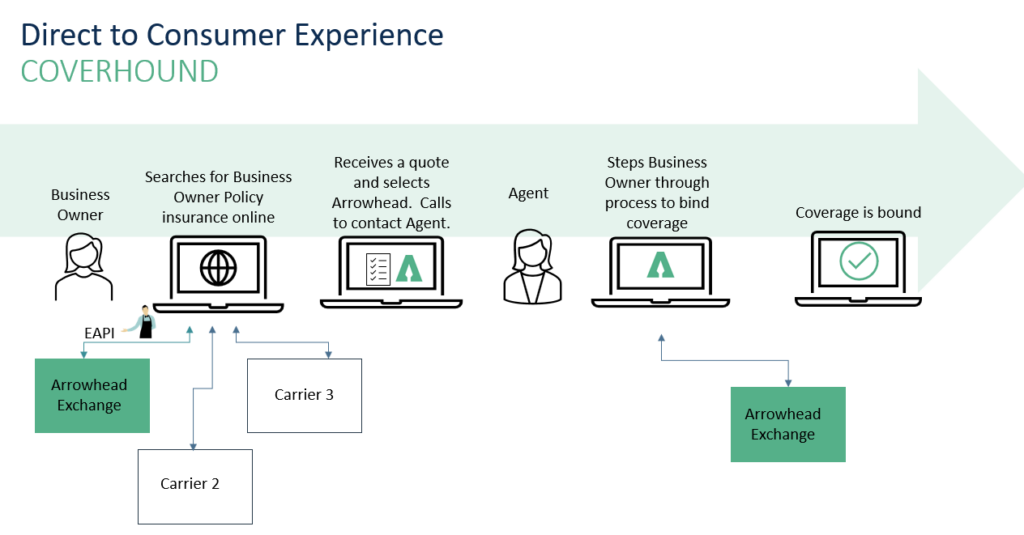

Here’s an example of how our API works with aggregator Coverhound.

Let’s say a plumbing company is searching online for workers’ comp policy and goes to Coverhound. That plumber/business owner adds in his information, receives several quotes and chooses Arrowhead. He then contacts one of our producers, who works with the plumber to ensure all information is correct and then binds the coverage via Arrowhead Exchange.

Most of the time, though it’s independent agents who are using the aggregators and our Enterprise API (EAPI). Here’s another example showing all three comparative raters that one of our programs had worked with.

How did this API strategy come about?

It began with a painstaking process of going through our online portal, Arrowhead Exchange, documenting every field and every option. The next step was to decide which fields and options we wanted to repeat from Arrowhead Exchange into the API layer and what should we do differently, such as defaulting certain answers, preselecting more options, hiding certain questions, all with a focus on streamlining. Our teams then built out the API, completing the extractions, then testing it to make sure that what we extracted would provide the same result as in Arrowhead Exchange.

“This was a huge, time-consuming project, and we pulled it off marvelously, in spite of the fact that we all had our regular day jobs,” Poletti added.

How did you choose which distributors you wanted to use?

“We selected different digital distributors to meet with, to understand their strategy, pricing and how they integrate,” Poletti explained. “From there we built a pros/cons list on each one, understanding what agencies we had in common already, how they were getting their submission flow, what types of business they were getting and their pricing structure. Even now, digital distribution market is still so new that there’s not a lot of data out there. But we went live with CoverHound in September 2021, Tarmika in November and then Semsee in May 2022.”

What are you seeing so far from these aggregators?

“One measure of success is the number of agents who previously didn’t know our risk appetite. Our visibility to agents who use the platforms has significantly increased. This will help us gain more appointments in the future, as these aggregators go mainstream,” explained Capp-Evans.

Monthly the aggregators send a report of all the accounts that meet our program’s risk appetite. These reports allow the team to focus on specific agents, reinforce relationships and follow up with them for greater success. In the future, as aggregators’ data grows, they’ll be able to see that each aggregator is bringing in X number of X type of business classes and what percentage this program is winning. They’ll also be able to pinpoint those accounts they lost, analyze reasons why and perhaps change direction a little bit.

How is this changing how Arrowhead does business?

“Digital platforms and APIs aren’t a case of ‘if you build it, they will come,’” Poletti explained. “We’ve seen a lot of tech-savvy agents – early adopters – using the platforms, but many others simply haven’t shifted into the technical evolution. We’re still very early in the journey towards aggregator use. Many carriers are slow to build their APIs as well.

“Now when we onboard new agents or train agents on our appetite, we include information about the platforms we’re on, so that they know they don’t have to use Arrowhead Exchange,” she added. “These comparative raters or these digital distributors are the future. So we’re always looking at new digital distributors, particularly if our API is easy to add their platform.”

What’s next for APIs?

“Arrowhead Programs has 30+ insurance products and brands; our job is to sell them to independent agents,” said Shomphe. “It can be a little confusing, because we all have different portals, use different technology and have different pools of data. For example, there’s one way to get appointed and start selling product through Wright Flood versus CalSurance versus Title Pac. They’re siloed. That creates a difficult agent experience, because each has its own sign-in and workflows. The Strategic API team has been working on two things to make that easier.

“First is third-party identity management (TPIM) so that agents will only need to use one username and password to unlock Arrowhead Programs’ different products. We’re working to standardize agent contracts and how we bring those agents on board. We want to be able to appoint them once and unlock all distribution throughout Arrowhead Programs,” he added.

“The other piece is creating APIs for the aggregators, expanding on what we’ve already learned with our first API. Rather than making agents come to us, we want to go where they are. Rather than them logging into Arrowhead Exchange to figure out how it works versus CalSurance’s portal versus American Specialty’s, they’ll log onto an aggregator where they can get a quote for as many of our products as they’re appointed to sell.

“The Strategic API team has built a chassis, so to speak, with our first program to be added to raters,” Shomphe explained. “Now we can reuse the chassis that’s already bolted in, for the next iteration. When it’s time to add in another product from Arrowhead Programs, the hard work has already been done, along with training, documentation and bug fixes. They’ve built for the future, while continuing to respect our current distribution partners, making sure we’re providing the coverages they need, but also making their jobs easier.”