How Arrowhead Programs helps MGAs launch new insurance products and programs

1. With a goal of multiple insurance product launches every year, Arrowhead Programs provides the support, resources and expertise MGAs need to go-to-market with a new product.

2. Our Product Development team connects experts with the MGA at every step, from data analytics and actuarial expertise to marketing, operations, finance, customer service, technology and more.

3. View the case study on Arrowhead’s E&S launch to see the steps taken from ideation to issuance.

Most MGAs we speak with are looking to launch a new product,” said Jimmy Curcio, chief strategy and analytics officer. “They want additional revenue opportunities – and likely already have the expertise – but could be missing the carriers, data and/or resources for a new insurance product launch.

“Whatever those needs are, our team of experts, led by the Project Management Office, works with them to overcome every hurdle on the way to a new product launch.”

“Yes, these MGA leaders know how to bring a product to market, but they’re short on time and resources. We bring all our experts together to support a new insurance product launch. We leverage the MGA’s ideas and expertise, and then fill in all the gaps with the multitude of capabilities that we offer,” explained Kelly Spies, director of the Project Management Office. “That means we save MGA leaders thousands of hours of time, allowing them to focus on the business at hand while we focus on the new product.”

Related: How Arrowhead Programs’ shared services helps companies grow

Spies’ team runs the product development playbook, responsible for the entire program launch, from idea to issuance. “We are the umbrella, so to speak, that starts with the new product idea, all the way out the door, until either the project is complete or we move into the next phase. That next phase could be a new offering, another supporting product, more automation, or another piece of the technology stack they’re looking to build,” she added.

Contracting is a huge piece of the process that PMO supports: getting a sense of carrier relationships, while at the same time building out the product and technology. By the time the contracting is complete, the go-to-market is firing on all cylinders, so to speak.

PMO also supports the new program/product through determining coverage and system needs. While our PMO isn’t experts on the forms, they do connect them with in-house experts to strengthen their offer. “We make sure the stakeholders have the support they need to draft and review forms, and then partner them with the claims team to review forms to prevent issues down the road,” explained Spies. The team also supports the accounting setup, making sure the new product is set up for billing through the general ledger process.

Our product development services

The Product Development team brings together Arrowhead Programs experts in these areas to aid in a new insurance product launch:

- Data science & analytics

- Actuarial

- Data engineering

- Policy administration

- Point of sale

- Innovation

- Finance & Accounting

- Marketing & Communications

- Operations

- Customer service

- Strategic API

- Vendor management

- Claims

Related: How our Data Science & Analytics team helps companies boost their bottom line

Ideation to Implementation

First steps in every product launch are to interview key stakeholders and then create supporting project documentation. Finally, the product leaders sign off on scope, resources, timeline, budget and key success metrics.

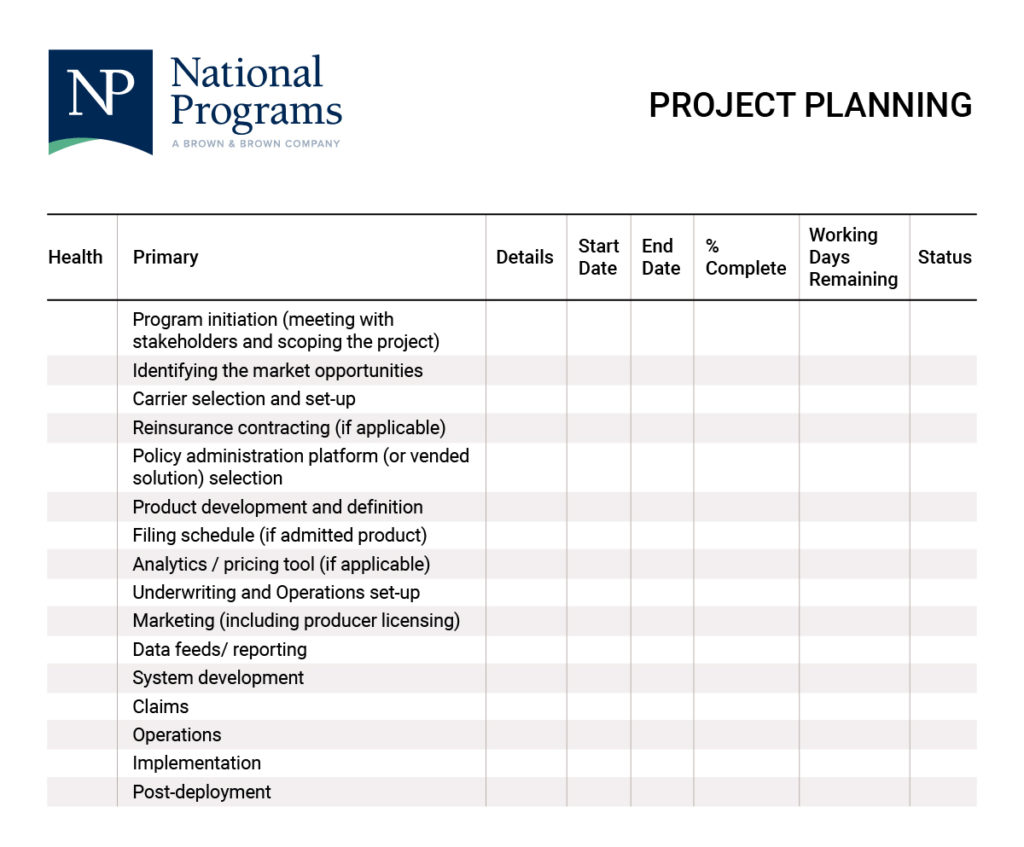

The project plan for a new insurance product launch includes these steps:

Arrowhead Programs’ growth strategy includes several product launches a year, building their number of programs beyond its current 65. Some are brand-new products; some are de novo products; others are expansions; then occasionally, the team aids in transitioning a program to a new carrier. Regardless, Product Development (PD) team uses a similar playbook for each insurance product launch to go to market.

Case study: E&S speed to market

From initial engagement to product launch, the PD team pulled together a group of experts to lay out a plan, then guide, organize and support the delivery of the Arrowhead E&S Program.

“When we joined the project, there had been a lot of talk and ideas batted about, and we were able to move those ideas into a concrete plan,” Spies explained. The project started with the stakeholders’ ideations, exploring market opportunity, identifying possible program leaders and defining a budget.

“Decisions on tasks, assignments, timelines, risk management, IT needs, reporting, automation, details of the actual product and more were what the PD team worked through, along with carrier options and final contracts – everything from A to Z,” said Spies.

Ideation and leadership

The idea-to-first-issuance process took only nine months for Arrowhead’s new E&S program. With a long track record of profitability in the E&S and specialty underwriting segments, this team saw the need in a hard market to build out a world-class operational and technology platform to set the program up for sustained profitability in years to come. Bill Murray was brought on as president and Rich Collins as vice president of operations; within six months they were hiring their team of underwriters.

Carrier selection

The chosen carrier is Obsidian Specialty Insurance Company, “A-“ (Excellent) A.M. Best rated paper. Obsidian is a new insurance fronting platform built solely to support the increasing market need of program administrators who want to connect with reinsurers that seek primary layer access.

Distribution

Starting with a limited and preferred distribution model, they leveraged existing trusted relationships with a small group of Wholesale producers from top brokers, who will deliver business that is both in-appetite and profitable.

Technology and policy administration platform

Arrowhead Programs has the talent and experience to deliver a high-quality and scalable technology solution, emphasizing speed-to-market with a rapid development and implementation approach.

“Our technology strategy enables Arrowhead’s new E&S Program to be lean, responsive and flexible,” said E&S Program President Bill Murray. “Our technology team developed a technology stack (clearance, rating, quoting, issuance, forms and performance tracking) that empowers us to be opportunistic in the marketplace. The platform captures and tracks performance data in real-time, enabling us to make better business decisions on-demand.”

The tech team built a powerful and flexible cloud rating engine built with an API-first architecture, along with a tight integration with claims systems to ensure comprehensive end-to-end data capture. The team leverages in-house capabilities of over 100 onshore technology teammates for platform implementation and management.

Product definition, development and pricing

Led by Murray, the team chose to offer Excess Casualty, targeting to be significantly above technical rates on all lines of business. They then defined the program appetite: both target classes and those to avoid, along with regional premium distribution and distribution limits.

In order to set pricing, an in-depth analysis of competing insurers in this space was performed, focused on loss & LAE ratios, direct earned premiums, rate changes and other factors.

Related: How a custom submission grader helps Lawyer’s Protector Plan increase profitability

Claims

The team chose American Claims Management (ACM) as their third-party claims administrator. ACM is a subsidiary of Arrowhead. “There are clear advantages to having our claim servicing tied to the underwriting team,” Murray explained.

“Our E&S Program was launched in just nine months, with the help of the product development team. Already we’ve begun to see some major successes, not only in speed-to-market, but in program growth,” Murray added.